On September 15, the House of Representative Ways and Means Committee released an 881-page proposal on how to raise over $3,000,000,000 in taxes from American families.

It set off a wave of panic from families who have failed to use existing planning tools and strategies that the government could take away at any moment.

What Were the Tax Provisions Affecting Individuals that Passed the Ways and Means Committee?

The reconciliation bill passed by the House Ways and Means Committee on September 15 includes many new tax provisions. Among them are some significant taxes on pass-through entities and small business owners. Despite the mantra of “tax the rich,” at least some of these provisions will hit small business owners, many of whom would not be typically be considered wealthy, particularly hard.

Here’s a brief breakdown of some of the significant provisions affecting individuals recently passed by the Ways and Means Committee:

- The new top marginal tax rate will be increased to 39.6% on taxable income over $400,000 for a single taxpayer, $450,000 for married individuals filing jointly, and $13,000 for trusts and estates. This provision is effective from January 1, 2022.

- The capital gains and dividend tax rates would rise to 25% for those individuals, trusts, and estates with taxable income at the top taxable rate. This provision is adequate for sales occurring or dividends received on or after September 13, 2021..

- The 3.8% net investment income tax will be imposed on income not otherwise taxed as dividends, capital gains, or wages for persons with income higher than $400,000 for single taxpayers, $500,000 for married individuals filing jointly, and all trusts and estates (no threshold). This provision is to be effective January 1, 2022.

- The maximum allowable deduction for the 199A deduction for pass-through entities would be available only for single taxpayers making $400,000 or less, $500,000 or less for married individuals filing jointly, and $10,000 or less for trusts and estates.

- A new 3% surcharge would be imposed on all income for either single or joint individuals having more than $5 million of income, or more than $2.5 million for married individuals filing separately or more than $100,000 of income for trusts and estates. This provision is effective from January 1, 2022.

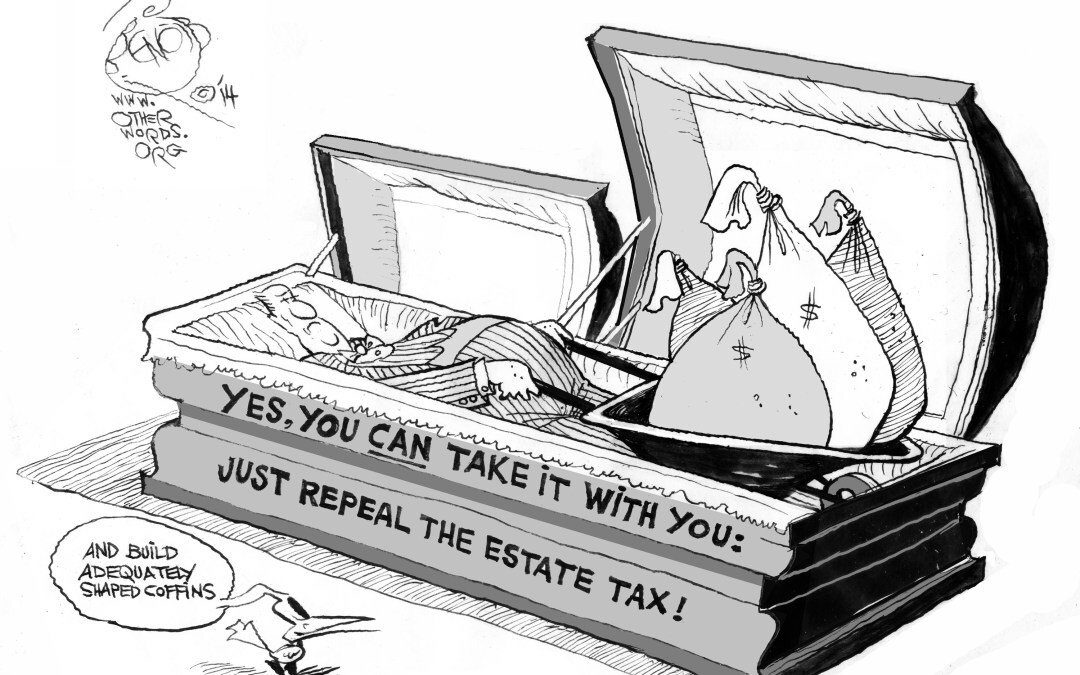

- Effective January 1, 2022, the gift and estate tax exemption would be reduced to approximately $6 million per individual (i.e., this would repeal the 2017 increase in the deduction four years earlier than slated under existing law).

- An $11.7 million estate tax valuation reduction at death for real estate used in a family farm or business that is included in the estate would be available effective January 1, 2022.

- For individuals with an income of $400,000 or more, no additional contributions can be made if the value of all of the individual’s IRAs, defined contribution accounts, and 403(b) accounts is more significant than $10 million, effective January 1, 2022.

- Effective January 1, 2022, two new Required Minimum Distribution rules apply to large IRAs (traditional and/or Roth) – for IRAs in excess of $10 million, 50% of the excess over $10 million must be distributed – for IRAs in excess of $20 million, 100% of the excess must be distributed. These IRAs are now referred to on the Hill as “mega-IRAs.”

- Taxpayers with more than $400,000 of income cannot make conversions to Roth IRAs after December 31, 2031.

- Starting January 1, 2022, IRAs will not be allowed to hold investments in an entity in which the owner has 50% or greater public security or, what will be much more likely, 10% or more of nonmarketable security. An IRA can no longer invest in an entity in which the IRA owner is an officer.

- Taxpayers with adjusted gross income in excess of $400,000 will no longer qualify for the special 75% and 100% exclusion rates for gains realized from Section 1202 stock – qualified small business stock.

Want to get a jump on your planning ahead of any new taxes? You don’t have to do your bookkeeping alone. Click the calendar below to schedule a complimentary strategy session with the team.